here will I be in 30 years? Or in 40? Will I be able to retire at 66? As the years go by, people retire later and later. Our average life expectancy increases every year, as a result of advances in science. This means that the odds are we’ll live long after we stop working. How do I make sure I'll have enough money to do what I want? Do I have to keep money under my mattress? Maybe this is not necessary. There are some solutions to this problem, and Coverflex can help you with that. But we’ll get to that later.

There are very few times that are not good to think about how to ensure we will always have enough money to live. You can read in this article some of our suggestions for this, namely the Savings and Retirement Plan available at Coverflex.

PPR - Savings and Retirement Plan: what is it?

First of all, we should clarify the concept of “Savings and Retirement Plan”. It sounds complex, but it isn't. It is important to guarantee a financial cushion for the future, and nothing better than some financial instruments - or, in other words, a kind of savings account - that allow us to invest a certain amount of our salary periodically in order to accumulate and make some profit. Fairly easy, right?

It is important to guarantee a financial cushion for the future, and nothing better than some financial instruments - or, in other words, a kind of savings account - that allow us to invest a certain amount of our salary periodically in order to accumulate and make some profit.

“But then isn’t it better to put my money in a deposit account?”. We've all thought this way. However, there are better ways to save and at the same time invest our money: investing in a Savings and Retirement Plan guarantees, unlike other types of investments, several highly appealing benefits. Here are some examples:

- Possibility of having deductions from the IRS collection (except in case of early withdrawal);

- The income generated by the Savings and Retirement Plan is taxed upon withdrawal;

- Income generated by the Savings and Retirement Plan benefit from favourable tax rates, starting at 21.5% and up to 8%, depending on the timing and form of withdrawal.

Now that we know what a Savings and Retirement Plan is, the second part of the question is missing… Where does Coverflex come into play?

Flexible benefits: the kind of compensation everyone is talking about

A concept that is becoming more and more common these days is that of flexible benefits: a way to save money for both the company and the employee, giving the latter the autonomy to spend the amount defined for these benefits in whichever is the most advantageous way, while providing a "smart" and motivating compensation.

A concept that is becoming more and more common these days is that of flexible benefits: a way to save money for both the company and the employee, giving the latter the autonomy to spend the amount defined for these benefits in whichever is the most advantageous way, while providing a "smart" and motivating compensation.

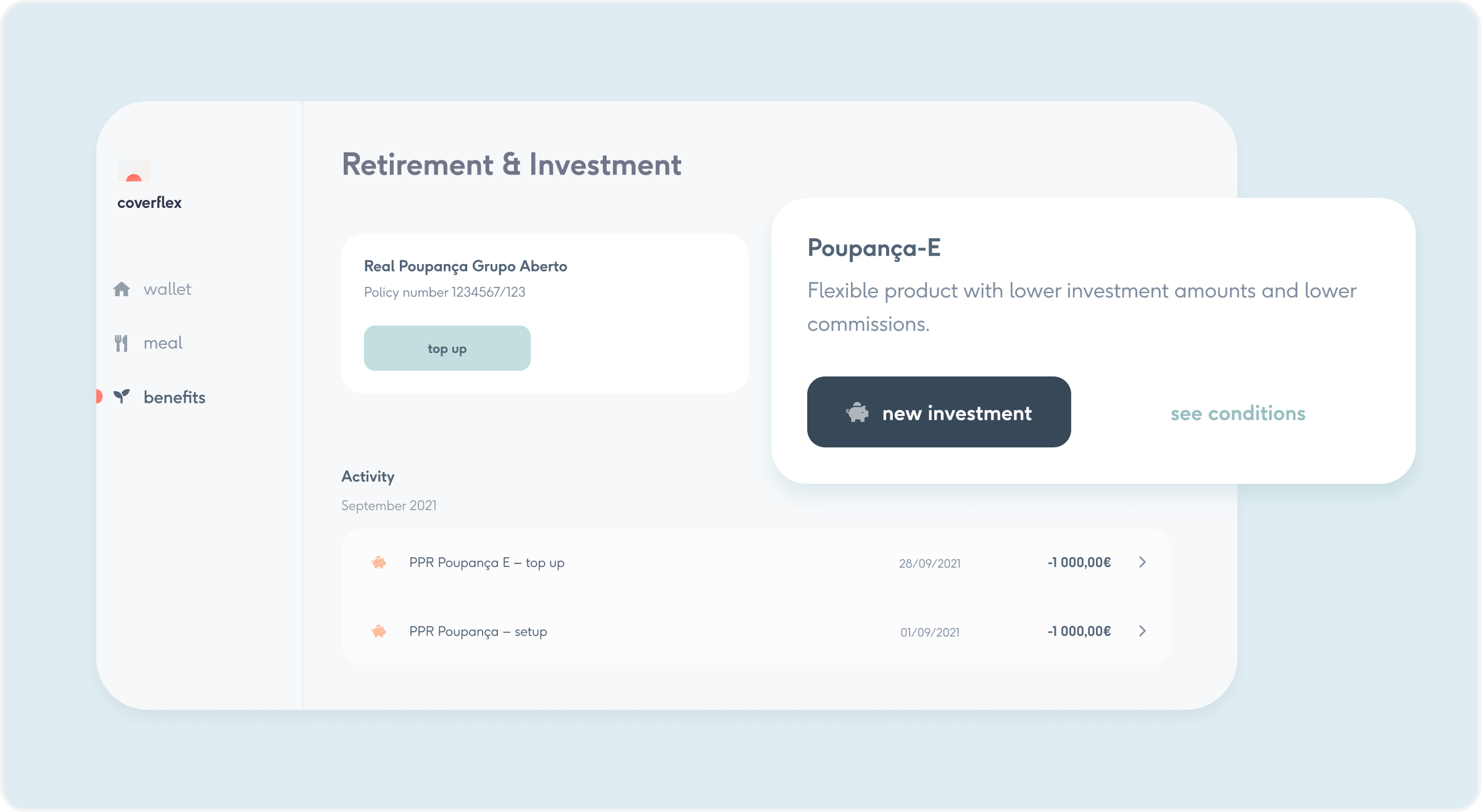

Of all the available benefits ay Coverflex, the most used is the Retirement & Investment one. We went to look for a Savings and Retirement Plan that would offer our users lower commissions on investment and withdrawal, and flexibility of ad hoc investments and recurring contributions… and we found Poupança E!

The PPR Poupança E is from Real Vida Seguros and has guaranteed capital. This new product has an investment rate of 0.25%; however, there is no obligation for monthly contributions. The minimum amount for the initial investment and subsequent contributions is €105 - from then on, you can contribute again whenever you want, either the following month, six months later, or even the following year.

In case of withdrawal, the rate is 1% in the first year, 0.5% in the second to fifth years, and 0% from the sixth year onwards. Subscribing to this Savings and Retirement Plan does not require company approval or paperwork, and you can manage it from the My Real Vida app.

You can read more about the "Savings and Retirement" benefit and other Coverflex benefits here.

Now that you've reached the end of this article, we only have one question for you… Are you still thinking about leaving the money under your mattress?