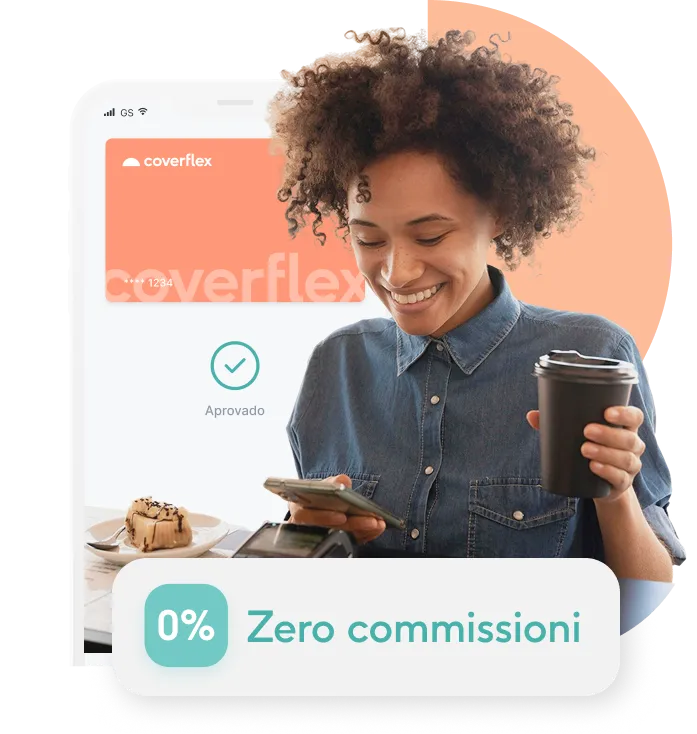

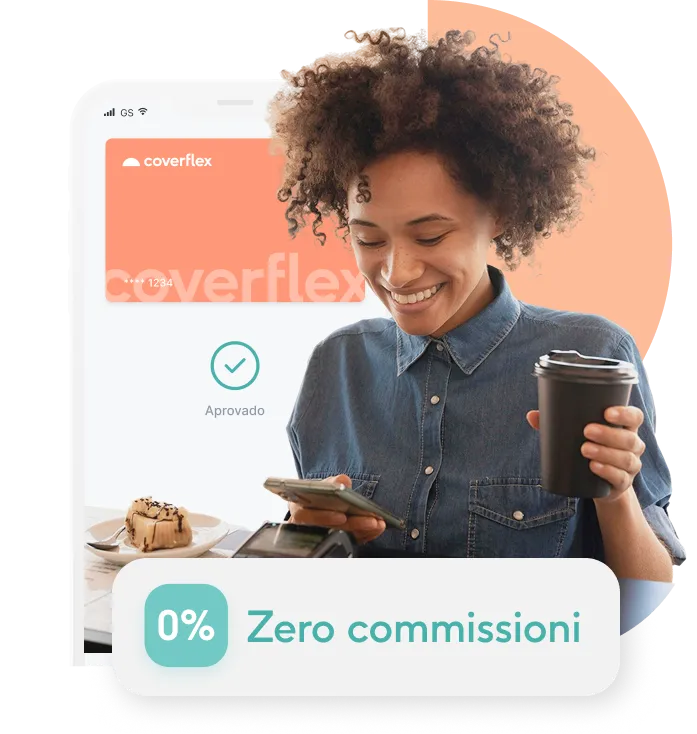

Un'unica carta, un solo pagamento

Il totale raramente è una cifra tonda e con Coverflex puoi finalmente dire addio ai conti divisi quando usi i buoni pasto. Basta collegare in app una carta di credito o di debito personale, così da completare il pagamento in un’unica transazione, usando solo la Coverflex Card. Niente resto, nessuna attesa alla cassa: solo un tap e via!

.avif)

.avif)

.avif)